are hearing aids tax deductible as a business expense

Are hearing aids deductible as medical expense. Can hearing aids be claimed as a business expense.

Hearing Aids Are Becoming More Affordable But Challenges Remain Npr

A client lawyer wants to deduct hearing aids as a business expense not medical for obvious 75 reason since he bought the aids to hear the judge during.

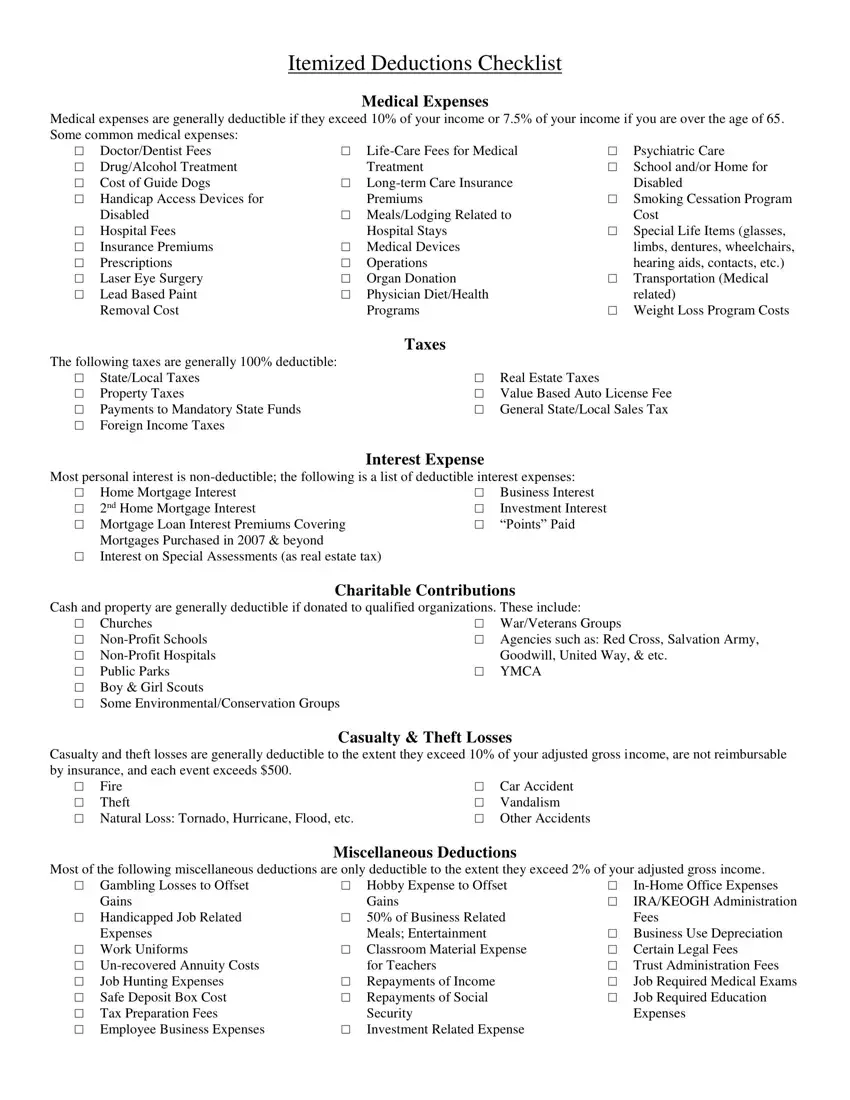

. Medical expenses including hearing aids can be claimed if you itemize your deductions. Hearing aids on average cost between about 1000 and 4000. The cost of hearing aids can be as high as 75 of your adjusted gross income.

While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways. The stipulation here for most people is that your medical. The high cost of hearing aids can mean that millions of americans avoid buying a hearing device because.

Health Costs Doctor visits gym memberships glasses hearing aids or massages. This means that they can be deducted from. Are Hearing Aids Tax Deductible As A Business Expense.

This means that if you need to wear a hearing aid just for your job for. The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them. The deductions for these costs are only available to those who itemize their expenses.

The good news is that if you are prepared to itemize your medical expenses you can save money. Track Your Hearing Loss Expenses. By deducting the cost of hearing aids from their taxable income wearers could reduce.

Hearing aids are an allowable medical expense for health spending accounts. I believe that in the case of a director the cost of hearing aids would be an allowable expense for the company but would indeed be considered a P11d. The cost of hearing aids is deductible as a medical expense on your federal income taxes.

According to IRS in addition to the price of hearing aid one can deduct for the doctors visit hearing test repairing of hearing. The short and sweet answer is yes. There are a few things to know about hearing aids and taxes.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. Hearing aids are most certainly a medical expense that is tax-deductible in Canada. However there are saidsome things to consider.

What are hearing aids. If youve already purchased hearing aids you can. Even the hearing aid batteries are tax deductible.

First hearing aids are considered medical expenses. These out-of-pocket premiums should be. They come under the category of medical.

Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it. So if you need a hearing aid just for your work.

Duality of purpose.

Hearing Aid Insurance Verification Faq And Answers

Are Medical Expenses Tax Deductible Chime

Donate Used Hearing Aids On Long Island Ny Mcguire S Hearing Centers

Estes Audiology Hearing Centers Good News On Tax Day If You Itemize Your Medical Expenses On Your Taxes Hearing Aids Are Tax Deductible Don T Take Our Word For It Check It

Children S Hearing Aids Program May Expand Calmatters

Common Health Medical Tax Deductions For Seniors In 2022

How Much Do Hearing Aids Cost Goodrx

Common Health Medical Tax Deductions For Seniors In 2022

How To Claim A Tax Deduction For Medical Expenses In 2022 Nerdwallet

Did You Know Hearing Aids Are Tax Deductible

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Here S How To Make The Most Of The Tax Break For Medical Expenses

The Cost Of Hearing Aids In 2022 What You Need To Know

Tax Deduction For Medical And Dental Expenses The Official Blog Of Taxslayer

Disability Tax Deduction For Wheelchair Vans Braunability

Itemized Deductions Checklist Fill Out Printable Pdf Forms Online

Which Expenses Are Deductible In 2020

Florida Lawmakers Carve Out 31 6 Million Tax Break For Business Meals